Getting The Tax Accountant Okc To Work

The team at F Silveira would like you to understand 6 things to consider when selecting an expert accounting partner (https://pblc.me/pub/9adde76a964bda). When selecting from accounting services, you must consider a company with relevant knowledge in company, tax, and accounting. With that understanding, they can offer you with significant information and vital suggestions

Experience in the field of accounting is also a fantastic step of a company's ability. Finding an accounting firm that is always offered when you require their services is essential.

Taxes Okc Things To Know Before You Get This

This helps you develop a strong relationship with your accountant which is required for you to trust them with your finances. tax accountant OKC. Paying for monetary guidance can create an avenue for more opportunistic and malicious people to benefit from you. For this reason, you must be wary of accounting services with exorbitant costs.

Companies that are in advance and transparent about their prices design ought to receive your factor to consider. A fantastic barometer of a firm's performance is its social standing.

The Facts About Accounting Firm Okc Uncovered

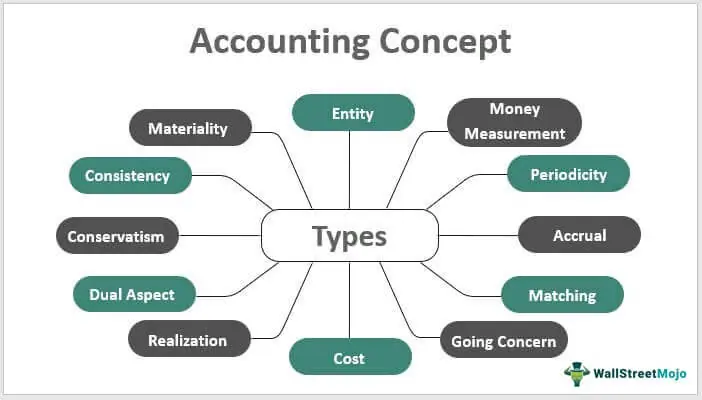

A company with a broad variety of professors can provide you with numerous options in-house without the need to contract out any of your monetary work. Basics like bookkeeping, financial planning, and tax preparation are essential for a small organization accounting service.

How some accounting services perform their business will also indicate how ideal they are for you. An accounting firm with this feature can move rapidly and devote less mistakes due to the automation of many jobs.

Accounting Okc Things To Know Before You Buy

Our firm offers customized services to satisfy all your requirements.

The Only Guide for Taxes Okc

Choosing the right is an important decision for businesses and people alike. Whether you need monetary assistance, tax preparation, or auditing services, selecting the finest accounting company can considerably affect your monetary success. This post will discuss the essential elements to think about when evaluating and selecting the finest accounting firm to meet your particular requirements.

All about Okc Tax Deductions

An enduring and positive track record is an excellent sign of a trustworthy accounting partner. Credentials and Accreditations: Make sure that the company's accounting professionals and specialists are qualified and certified. Licensed Public Accountants (Certified Public Accountants), Chartered Accountants (CA), or other appropriate certifications demonstrate a dedication to high expert standards and principles. These credentials are particularly crucial when seeking services connected to taxes and financial compliance.

Interaction and Availability: Reliable communication is key when working with an accounting firm. Select a company that values client interaction and is available when you have concerns or concerns. Clear interaction ensures that you stay notified about your monetary matters and can make educated choices. Comprehend the fee structure of the accounting company.

5 Easy Facts About Accounting Firm Okc Described

Transparent pricing and a read this article clear understanding of how you will be billed can help you prevent unexpected costs. tax accountant OKC. Consider the size of the accounting firm and how it may affect your experience - https://us.enrollbusiness.com/BusinessProfile/6572942/P3%20Accounting%20LLC. Bigger companies might provide a wider variety of services and expertise however can sometimes do not have an individual touch

Choose a company that lines up with your preferences. Area and Availability: If you choose face-to-face conferences, think about the place of the accounting company. Proximity can be crucial, particularly if you need to visit their office routinely. Nevertheless, in the age of remote work, numerous firms use online services that make place less important.

Excitement About Tax Accountant Okc

Reviewing real-life examples of their work can give you a better understanding of their capabilities and how they can include worth to your monetary scenario. Choosing the best accounting company is a choice that must not be ignored. Think about the aspects gone over in this short article to make an informed choice that lines up with your specific financial requirements and goals.

As an organization owner, you understand the ins and outs of your industry. That stated, you'll likewise need the financial knowledge to ensure your company is established for monetary durability - accounting OKC. That's why discovering the best accounting company can make all the difference in ensuring your business's cash is handled well, decreasing your tax burden, and beyond